In order to use EyeQ Tech solutions for Banking, all customer need to register their faces with the EyeQ Tech system only once.

Registration:

The registration process is simple, can be done via online system (webcams, smartphones) or directly at transaction points or automated banking kiosks.

Check & Confirm:

EyeQ smart cameras verify customer identification and provide information to bank staffs in real-time.

Using these information, bank staffs can rearrange, select and confirm successful EyeQ-ID registration. Customers can then conduct transactions through EyeQ identification system.

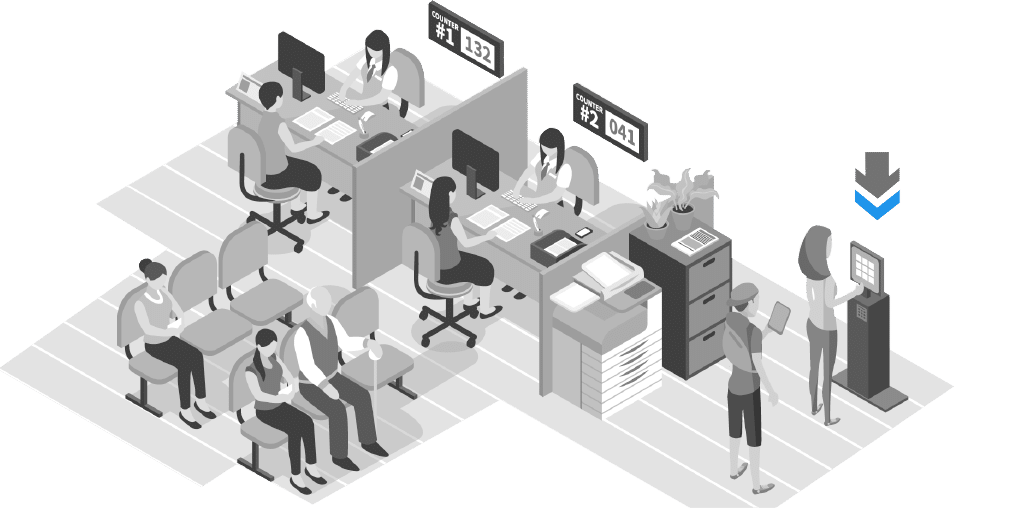

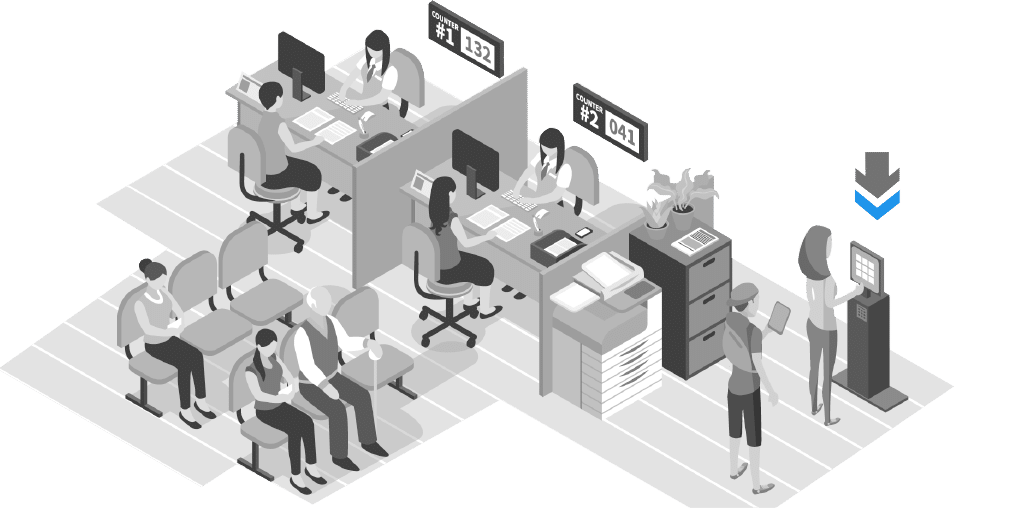

Take-a-number machine:

At take-a-number machine, use AI cameras to differentiate new customers with familiar ones and welcome them accordingly.

For customers registering to our system before, it successfully identifies and shows personalized greetings, then guides customers to contact desks. For VIP, it could send direct notice to branch managers so that they have more time for preparation.

Existing bank customer access to the website and want to register to use the service (opening an account, opening an ATM, Debit card) advertised on the website:

Unregistered customer EyeQ-ID:

EyeQ system guides customers to register for identity and to complete the procedure.

Existing customer of the registered bank EyeQ-ID:

EyeQ system guides customers to open cameras to authenticate identity. EyeQ Tech system successfully authenticate customers with the correct identification information provided. The bank carries out the service according to the customer ‘s request. In addition, customers can scan the necessary documents for the approval of the product (depending on the specific requirements of the bank) with the EyeQ Tech – OCR application sent to the bank to register all product online, at every place.

Existing bank customer want to check account balances, but do not register intener banking and mobile banking, customers access the bank website and select the section ‘ Look up account information through identification’

Customer who have not registered EyeQ-ID

EyeQ Tech system instructs customers to register for identification and go to the transaction office to complete the procedure. The bank website allows customers to access the lookup of their account information( view-only mode or more detailed depending on the case).

Customers who have not registered EyeQ-ID:

EyeQ Tech system instructs customers to register for identification at customer service counters for future use.

Existing bank customers registered with EyeQ-ID:

EyeQ Tech system successfully authenticates customer with identity information provided. ATMs and kiosks allow customers to access their accounts to make transactions.

Using banks’ security cameras, it is possible to set up separated EyeQ system at branches & bank transaction offices to measure on-site operation, number of branch visitors, basic demographic information (group age, gender), peak hours, waiting time, number of passengers handling at each transaction desk…

EyeQ system also measures the interest level of customers to advertising videos displayed at brances by measuring views, tracking views, watching duration of each person. Algorithms record characteristics which help security departments quickly identify and review back up cameras according to identification (age, gender, clothing colors, glasses …) and alert when the system identifies smoke, fire, scuffle, injury, etc.